Sitting on a gold mine: value of British homes soars by £1.6 TRILLION over the past five years – with 11.9 million homes increasing in value by over the £49,000 average

Open market value of Britain’s homes now totals £9.2tn - four times the UK’s GDP, and more than four times the value of all companies listed in the FTSE 100

The rise of £1.6tn is around the same as the market cap of Apple – the world’s largest company by value

Value of homes has risen by £550bn in the last year - driven by soaring buyer demand and the pandemic-led ‘search for space’

Average property has risen in value by almost £50,000 over the past five years. A huge 88% of homes in Monmouthshire have risen by more than this, while in Hastings and Trafford this figure stands at 83% and 82% respectively

Value of homes in 13 sq miles of Westminster, Kensington and Chelsea is the equivalent of Wales’ entire housing stock

The total value of homes in Britain has risen by 20% - a huge £1.6tn – in the past five years, according to new data from Zoopla, the only website to provide the real time monthly value of every home in the UK. There has been a sharp acceleration in the total value over the past year in particular, driven by soaring demand for homes and the pandemic-led search for space. Of the £1.6tn, over a third (£550bn) of the increase has been in the last 12 months.

With almost 12 million homes increasing in value by the national average of £49,000 or more over the past five years, homeowners can use Zoopla’s My Home to see how much their home is worth.

The total value of homes in Britain currently stands at a staggering £9.2tn. The majority of this (£8.2bn) is held within 23.5 million privately-owned homes, whilst a further £1tn is held within five million social homes.

Demand driving up values

Sustained price growth in the housing market since 2016 has been underpinned by ultra-low mortgage rates. Over the last 18 months, increased demand and limited supply has put further upward pressure on prices while the pandemic has led to many reevaluating what they want from a home.

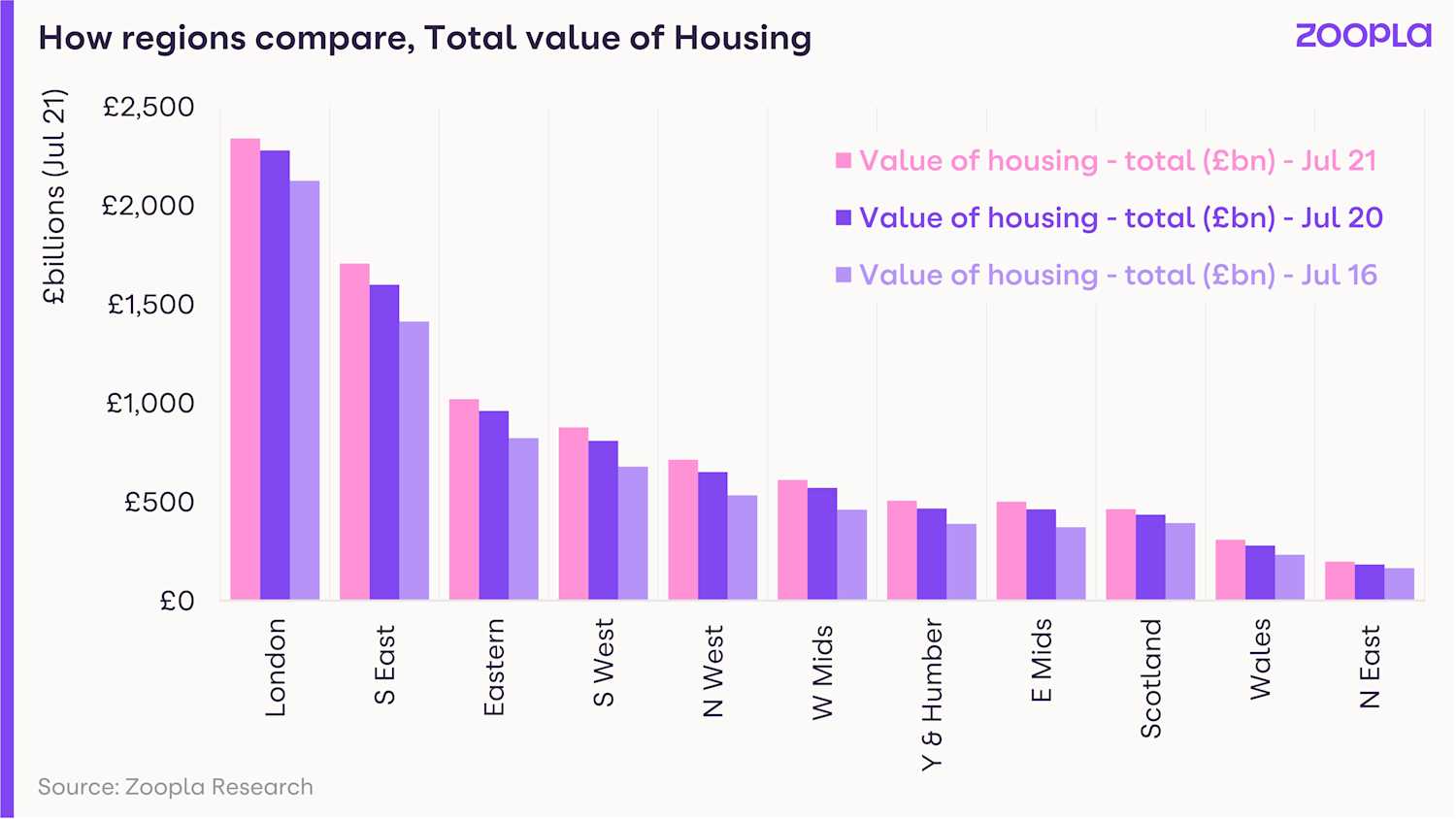

Total home values in the South East have risen more than anywhere else in the past five years – including London. The value of homes in the South East has increased by £294bn compared to £214bn in the capital. However, whilst London only accounts for 13% of British housing stock, it is responsible for a quarter of its total value.

UK housing PLC

To put the huge figures into perspective, the total value of UK homes (£9.2tn) is more than four times the GDP of the UK and over four times the value of the entire FTSE100. The rise of £1.6tn over the past five years alone is around the same figure as the market cap of Apple – the world’s most valuable company.

When looking at privately owned homes and accounting for outstanding mortgage debt – of which there is currently £1.6tn - £6.6tn of the equity is currently in the hands of owners of privately-owned homes.

Who are the winners?

There is a high concentration of value in some specific local authorities. For example, the value of homes in the City of Westminster and Kensington and Chelsea (£306bn) – which combined cover an area of just 13 square miles – is higher than all the homes in the North West (£197bn) and roughly the same as Wales (£308bn).

But it’s not just multi-million pound addresses that are recording significant price increases. Instead, 11.9m homes have registered an above average price rise (+£49,000) over the last five years. 88% of homes in Monmouthshire have risen by more than the average while Hastings and Trafford are also in the top three, with 83% and 82% of homes in these local authorities rising by £49,000 or more since 2016.

Gráinne Gilmore , Head of Research, Zoopla, comments:

“The value of Britain’s residential property has continued to climb over the last five years, speeding up over the last 12 months as house price growth has escalated. The price and density of homes dictate where the largest concentrations of housing value are located, however, in some local authorities, more than two-thirds of homes have risen by more than the average. To check the value of your home, visit MyHome at Zoopla, or contact your local agent.

“Understanding the value of your home, and the equity you hold within the property, can help when it comes to making future plans.”

Top ten British local authorities by property value

Position | Local authority | Region | Value of all housing in £bn (July 2021) |

|---|---|---|---|

1 | City of Westminster | London | 164.6 |

2 | Kensington and Chelsea | London | 141.0 |

3 | Wandsworth | London | 117.3 |

4 | Barnet | London | 114.1 |

5 | Birmingham District | West Midlands | 102.3 |

6 | Camden | London | 100.5 |

7 | Cornwall | South West | 91.8 |

8 | Lambeth | London | 86.8 |

9 | Richmond upon Thames | London | 81.8 |

10 | Bromley | London | 81.8 |

- Ends -

Methodology

The figures are based on Zoopla’s Automated Valuation Model (AVM) which carries out monthly valuations in order to accurately assess the value of all homes in Britain.

Notes to Editors

Research conducted by Zoopla in October 2021. Data is based on values provided by Zoopla’s Automated Valuation Model (AVM) which carries out monthly valuations to provide the best indicator. The above data is from July 2021 (the most recent available) and compared to AVMs in July 2020 and 2016. The information and data in this report was correct at the time of publishing and high standards are employed to ensure its accuracy.

About Zoopla

Hello. We're Zoopla. A property website and app.

We know you're not just looking for a place to live. You're looking for a home.

Yeah, we've got over a million properties for you to browse.

Tools that let you filter them in all kinds of clever ways.

And reliable house price estimates, so you can be sure you aren't paying over the odds.

But we know you're looking for more than that.

Because that first flat won't just be a 'great investment opportunity'.

It'll be the feeling of starting out on your own.

That extra bedroom won't just mean another £20K on the re-sale price, it'll mean having your sister over to stay.

And that bungalow won't just be a way to release some equity, it will be a chance to spend more time with the grandkids.

We know that searching for a home is about more than just checking its price, location and features (important as all those things are).

What really matters is how it makes you feel.

We know what a home is really worth.

So let us help you find yours.

Zoopla is part of Zoopla Limited which was founded in 2007.

Zoopla Limited, The Cooperage, 5 Copper Row, London, SE1 2LH Registered in England and Wales with Company No. 06074771 VAT Registration number: 191 2231 33 Data Protection number: Z9972266