Whatever you’re planning for your home, it’s well worth exploring what financial support might be available.

You just have to know where to look.

Government grants for home improvements

Local authorities are able to offer financial support with home improvements, but the level varies depending on the area you live in.

If you apply to your local authority for help with home improvements, it must

take your individual circumstances into account

make sure that a copy of its rules, including the types of help it provides, are available for you to look at, free of charge, at its main office

take into account your ability to repay any help it offers you, before you commit. For example, it shouldn’t offer you a loan if you can’t afford to repay it

get your consent before carrying out any works on your home

Different local authorities have different rules. For example, some state that you may be unable to get a grant if your savings are over a certain amount.

Your local authority will be able to tell you what's available where you live and if you qualify.

If you rent your home and apply for help with home improvements, you'll need to make sure you have your landlord's permission before your local authority will agree to anything.

Find out more about help with home improvements from Citizen’s Advice

Find your local authority here

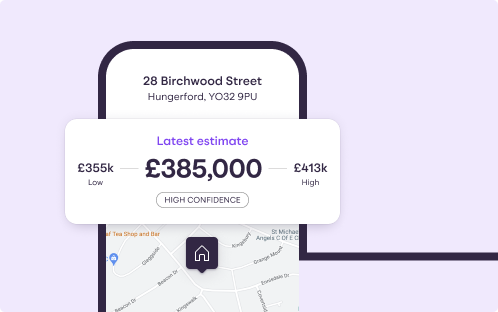

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

Support to make your home more environmentally friendly

You may also be able to get financial help for any energy-saving work you do to your home.

The Energy Company Obligation (ECO) is a scheme where energy suppliers help with energy efficiency improvements, such as insulation work or replacing or repairing your boiler.

A number of major energy suppliers are signed up to ECO.

Find out more about the Energy Company Obligation Scheme

There’s also the Boiler Upgrade Scheme, which offers grants to cover part of the cost of switching fossil fuel heating systems, such as oil, gas or electric, to a heat pump or biomass boiler.

Find out more about the Boiler Upgrade Scheme

The scheme is available in England and Wales but there are also initiatives in Scotland and Northern Ireland.

The government has big sustainability ambitions, so it’s worth keeping your eye on developments in this area.

It recently unveiled a new scheme, Green Home Finance Accelerator, in a bid to help homeowners make green improvements in future.

Find out more about the Green Home Finance Accelerator

Free money to make your home more energy efficient

Home Improvement Agency

You could also approach your local Home Improvement Agency.

Designed to make homes warm, safe and secure, Home Improvement Agencies are not-for-profit organisations that offer a range of home improvement support services for older, disabled and vulnerable people.

Find out more about help available in Scotland, Wales and Northern Ireland.

Disabled Facilities Grant

If you’re disabled and want to alter your home to make it better suited to your needs, you could be eligible for a Disabled Facilities Grant in England, Wales and Northern Ireland.

This could pay for alterations, such as installing a stair lift or ramps or improving access to outside.

There is similar support available in Scotland.

Support for Mortgage Interest

Support for Mortgage Interest (SMI) could be an option if you’ve taken out a loan to fund your home renovations.

The scheme gives a helping hand towards interest payments on loans for particular home repairs and improvements.

You usually need to be getting, or treated as getting, a qualifying benefit to get SMI.

SMI is paid as a loan and you’ll need to pay it back with interest.

Find out more about Support for Mortgage Interest

It’s also available in Scotland, Wales and Northern Ireland.

Secured and unsecured loans

Another way to fund a home renovation project is to take out a secured or unsecured loan.

Let’s look at the details.

What's a secured loan?

A secured loan is where you borrow money against something you own, such as your property.

An unsecured loan isn’t secured against an asset.

You may be able to borrow more with a secured loan, and they tend to have lower rates than unsecured loans.

With any loan, the lender will assess your personal circumstances before deciding how much they will offer you.

Before taking out any loan, you’ll obviously need to make sure you can afford your repayments now and in the future.

Examples of secured loans

1. Remortgaging your property

You may be able to remortgage and borrow more money - in effect, releasing money tied up in your property.

This means switching the mortgage deal on your home, either with your existing lender or a different one.

There’s a lot to weigh up so find out more in our guide, should I remortgage to renovate?

Save money with Mojo Mortgages

Allow award-winning Mojo to show you the best rates available to you. A whole-of-market broker, Mojo work with over 70 lenders. And they won't charge you a penny for their services.

2. Extending your mortgage

You could ask your existing mortgage lender if you could borrow more money.

This may be a good option if your mortgage deal doesn’t come to an end soon.

It’s worth remembering that the rate on the additional sum of money could well be different to the one on your existing mortgage.

3. Second charge

Alternatively, you may want to consider a second charge, another loan secured against your home.

Simply put, you’d have two loans on your property: the existing mortgage and a second charge.

The second charge is normally borrowed through a different lender.

To take out a second-charge mortgage, you'll also need to get permission from your existing mortgage lender.

This helps to prove to the second-charge mortgage provider that you can afford the repayments on both loans.

A second charge loan often has a higher interest rate than your primary mortgage, because for second charge lenders, it's a bigger risk.

4. Equity release

If you’re an older homeowner, aged 55 or over, then equity release could be an option. It is another way to unlock money from your home, either as a lump sum or smaller payments.

There are typically two ways to do this:

Lifetime mortgage, a loan that allows you to continue to own your home

Home reversion plan, where you sell a chunk or all of your home to a provider (without needing to move out).

You can get more details in our guide, should I release equity from my home?

It’s a really good idea to speak to a reputable financial advisor and/or mortgage broker about the options available to you.

They will be able to give you professional advice based on your particular circumstances.

There is a risk that your property could be repossessed if you don’t keep up with your loan repayments.

What's an unsecured loan?

An alternative to borrowing money against your property (or another asset) is to lock in an unsecured loan.

Naturally, interest rates and other conditions vary so be sure to read the small print. And remember too that late or missed repayments may hit your credit score.

Examples of unsecured loans

1. Personal loans

Personal loans offer flexible use, short- to moderate-term repayment options and relatively quick funding.

They typically come with fixed or variable interest rates, as well as repayment terms that range from just a few months to up to seven years - though some can go longer.

The advantage of taking out a personal loan is that it doesn't come with the threat of losing your home if you default on your repayments.

Compare the best and cheapest loans at Money.co.uk

2. Credit cards

Alternatively, you may want to consider using a credit card, particularly if you’re planning smaller-scale home renovations.

But be sure to pay it off as soon as physically possible, so that the interest doesn't mount up.

Discover the best credit card deals at Money.co.uk

This is a guide only. It’s important to seek independent financial advice based on your personal circumstances.