The average house price in the UK is £263,900 as of February 2024 (published in March 2024).

Property prices have risen by £200 compared to the previous month and fallen by £900 (-0.3%) compared to a year ago.

Key figures

Average house price in December 2023 | Average house price in January 2024 | Average house price in February 2024 | Year-on-year change to February 2024 (£) | Year-on-year change to February 2024 (%) | |

All property | £263,700 | £263,700 | £263,900 | -£900 | -0.3% |

Detached houses | £446,000 | £446,700 | £446,800 | -£3,700 | -0.8% |

Flats | £189,800 | £190,000 | £190,200 | -£600 | -0.3% |

Semi- detached houses | £268,600 | £269,000 | £269,600 | +£900 | +0.3% |

Terraced houses | £231,600 | £231,800 | £232,500 | +£1,200 | +0.5% |

The graph shows how the UK’s average house price has changed in the last 10 years.

House prices firming with no sign of faster growth

The annual rate of UK house price inflation remains negative at -0.3%. This is up on the recent low of -1.4% in October 2023.

There’s a clear divide across the UK in terms of house price growth. Prices continue to fall in southern regions, led by the East of England (-2.3%) and South East (-2.0%). On the other hand, house prices are rising the most in Northern Ireland (+4.1%) and Scotland (+2.1%).

All parts of the country are recording higher house price inflation than 6 months ago. Sales volumes are recovering and pricing levels are firming up across the UK housing market.

We expect these trends to continue into the second half of 2024 as house prices continue to adjust to higher mortgage rates and reduced buying power.

Housing market activity continues to improve at the start of 2024

Our House Price Index shows that all primary measures of housing market activity have positive momentum in March 2024.

9% more property sales agreed than last year

The number of sales agreed is currently +9% higher than a year ago. Over the first 3 months of 2024, there were +7% more sales compared to the same period in 2023.

The strongest growth in sales is in housing markets with more affordable house prices, including the North West (+13%) and Yorkshire and the Humber (+11%).

A fifth more homes for sale than last year

The rise in agreed sales is encouraging more sellers to put their home on the market.

The average estate agent had +11% more properties on the market in the last 4 weeks than they did this time last year. Overall, there are a fifth more homes for sale compared to a year ago.

The strongest growth in new sellers putting their home up for sale is in the South West (+28%) and North East (+26%).

The supply of homes for sale in London is only +8% higher than a year ago. This explains why house price inflation is rebounding faster than in other regions.

Why is there more activity in the housing market?

There is improving sentiment in the UK housing market and it’s down to faster real wage growth and a healthy jobs market, both of which are boosting consumer confidence.

The latest GfK Consumer Confidence survey found that confidence about personal finances has hit the highest level for more than 2 years.

At the same time, the average mortgage rate for a 75% loan-to-value ratio on a 5-year fixed rate has fallen to 4.4%. That’s more than 1 full percentage point down from a high of 5.8% in June 2023.

41% of sales agreed are at least 5% below asking price

Despite rising confidence and market activity, buyers remain price sensitive and continue to negotiate on price.

Two-fifths (41%) of sales agreed in March 2024 were at least 5% below the asking price.

Back in the last 3 months of 2023, this figure was closer to half of all sales - but it remains high by historical standards. This reinforces my view that house price inflation will remain broadly static during 2024.

Discounts on asking prices return to pre-pandemic average

The difference between asking price and agreed sale price is continuing to narrow in further evidence of improving market conditions.

The average (median) discount was 4.5% in November 2023 - from initial asking price to agreed sale price. This equated to £14,250 in monetary terms.

According to our March 2024 House Price Index, the average discount is now 3.9% or £10,000. This is the lowest since July 2023 and in line with the pre-pandemic average.

Smaller discounts reflect a combination of greater realism from sellers on where to set their asking price, along with growing buyer confidence.

We’re seeing this trend across the UK housing market but discounts remain larger across London and the South East, with discounts of 4.3% on average. This is where house prices are higher and posting annual price falls. Across the rest of the country, the average discount to the asking price is 3.4%.

Greater choice for buyers keeps house prices in check

My view is that a greater availability of homes for sale will also keep house price rises in check.

In the first 3 months of 2024, the average estate agent had almost 30 homes for sale - a return to the pre-pandemic average. This gives buyers choice and room to negotiate, especially if homes fail to attract interest quickly.

Zoopla data shows that a third of homes for sale have been on the market for more than 3 months and are still listed at the initial asking price.

This is evidence that sellers need to remain realistic on where they set their asking price if they are to take advantage of improving market conditions and sell their home in 2024.

The homes sat on the market for more than 3 months are potential candidates for a price reduction. It could help attract more buyer interest, although it will depend on what price the seller needs to unlock their next move.

What impact will lower mortgage interest rates have in 2024?

I expect rising disposable incomes to be the main driver of better housing affordability over 2024. Disposable incomes are projected to increase by +3.5% over the year while I expect house prices to remain flat.

The timing and scale of interest rate falls - and the subsequent impact on mortgage rates - is another key factor that could boost market sentiment.

Fixed rate mortgages today are already priced around expectations of a drop to interest rates, but a further reduction would likely result in further falls to mortgage rates. It depends on how low money markets see the Bank Rate falling.

Economists currently predict the Bank Rate to fall to 3.5% by the end of 2025. If accurate, it’s expected that mortgage rates will stay around the 4%+ range.

This would support sales volumes but would require incomes to continue to rise faster than house prices to help reset housing affordability, especially in southern England.

Download the Zoopla House Price Index: March 2024 (PDF, 264.30kB)

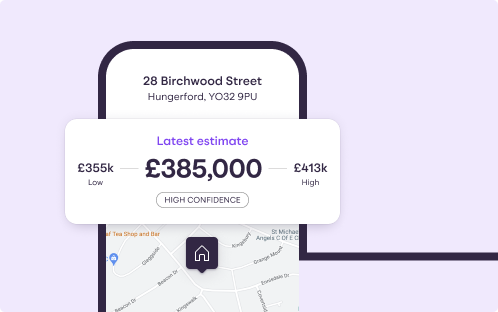

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

Previous House Price Index reports

See more stories from our House Price Index

About our House Price Index

The Zoopla House Price Index (HPI) is a repeat sales-based price index, using sold prices, mortgage valuations and data for recently agreed sales. The index uses more input data than any other and is designed to accurately track the change in pricing for UK housing. It’s a revisionary index and non-seasonally adjusted.

The HPI for March 2024 uses the most recent full data available up to February 2024. We revise previous data where needed to ensure the most accurate representation of the market at any given time.