Q. Richard, it’s been more than two months since the housing market reopened in England. What trends are you seeing now?

A. We are still seeing demand that built up during lockdown coming back to the market in England - and this is showing up in sales figures, with the number of sales agreed now running significantly higher than early March.

There are also strong indications that some households used lockdown as a chance to reassess how, and where, they live. These people are now entering the housing market, listing their home for sale and looking for their next home.

Q. What about Scotland, Wales and Northern Ireland?

A. As these markets have opened up over the last month or so, we have seen similar trends emerge, with demand rising and sales starting to climb too.

Q. So activity in the market is back to ‘normal’?

A. Sales numbers have certainly bounced back, but to put this in context, the number of sales agreed between January and July this year are still 20% lower than the same period in 2019.

As a result, we expect overall transaction levels to be around 15% lower this year as a whole - a significant fall, but a much more modest decline than many were expecting back at the start of lockdown in March.

Q. What does this mean for prices?

A. The higher levels of activity in the market are a hallmark of the rise in demand we have seen as markets have opened up. But we are seeing very clearly that this demand is not being matched by supply across the UK.

What I mean by that is that the number of households deciding to put their home on the market is currently far outnumbered by the number of households hoping to buy.

This imbalance between demand and supply is actually putting upward pressure on prices at the moment, and as a result we have seen the headline rate of price growth for UK homes rise to 2.7% in June, up from 2.4% in May.

Q. Are all the regions seeing this trend too?

A. Broadly that is right, yes. But when we dig into our House Price Index and additional data at a more granular level, some differences emerge. For example, in some city markets the imbalance between demand and supply is varied, as shown in the chart below.

It is no coincidence that the cities to the right of this chart, including Sheffield, Liverpool and Manchester, where demand is outstripping supply the most, are the places where house price growth is currently the strongest.

Q. The demand in many cities seems strong from this data, but we are hearing a lot about people moving to more rural areas?

A. We have seen increased demand in areas adjacent to cities. There are some buyers who are considering such a move, especially if their commuting patterns are set to change and they don’t have to travel to the office every day.

However, we believe that this is a ‘one-off’ factor rather than a seismic shift. We can see that in many city markets the largest demand is for properties within the city limits, and as markets start to reopen, there will be some rebalancing back towards higher density areas within cities.

Q. What impact has the stamp duty announcement had?

A. As we examined in our stamp duty research earlier in the year, London and the South East were always set to benefit the most from any stamp duty holiday. That's because higher average prices mean that buyers in these regions can make the biggest savings.

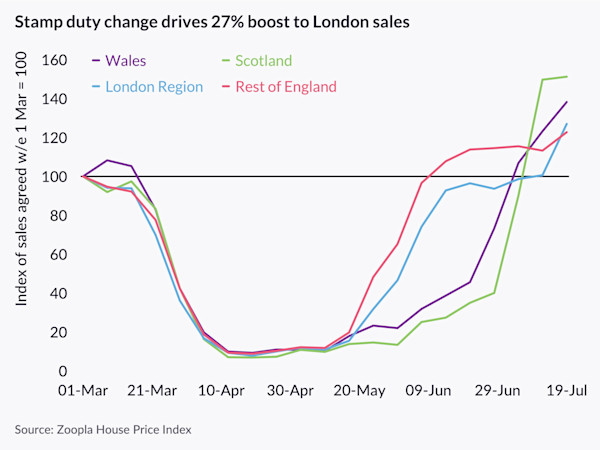

Our data is showing that this is the case, with a notable 27% jump in demand from purchasers in the weeks since the announcement earlier this month.

Q. What’s the outlook for the rest of this year?

A. We expect the annual rate of pricing to remain within the 2-3% band well into the fourth quarter, October to December, as the current demand in the market supports pricing.

The economic landscape, especially unemployment levels, will impact how pricing evolves into 2021.

Richard, thank you very much!

.jpeg)