New analysis of Land Registry and Registers of Scotland data has revealed just how much sellers across the UK have been cashing in over the last 18 months. Spoiler: it depends a lot on where you live, what you own, and how long you’ve been there.

On average, sellers in England and Wales made £72,000 profit when selling their home (that’s the price of a new Tesla). That’s roughly a 38% boost on the price they originally paid. Not bad for simply living somewhere!

But the story isn’t the same everywhere. Some regions are true golden tickets, while others have been a little slower to reward homeowners.

Where homeowners are making the most money

London and the South East are the jackpot regions. Sellers here typically walked away with £130,000 and £94,000 profit respectively. To put that into perspective, £130,000 could buy you an average-priced home in 11 local authorities in the North. Talk about relocating with change to spare.

The reason? Higher property values, longer stays in homes, and strong price growth in the years before Brexit.

In contrast, the North East has been a tougher market. Sellers there made around £35,000 profit on average, which works out at about 26% of their original purchase price. This lower return reflects the region’s long recovery period following the 2008 financial crash, when prices took more than a decade to bounce back. However, on the plus side, the North East is now enjoying stronger-than-average price growth, driven by its relative affordability and increasing buyer demand.

Avg. gains during sale (£) | Avg. gains during sale (%) | Avg. time in property | Median sold price | |

|---|---|---|---|---|

London | £130,000 | 35% | 10 | £513,000 |

South East | £94,000 | 35% | 9 | £370,000 |

East | £84,000 | 36% | 9 | £330,000 |

South West | £80,000 | 37% | 8 | £303,000 |

West Midlands | £70,000 | 41% | 9 | £247,000 |

East Midlands | £68,000 | 41% | 8 | £243,000 |

Wales | £65,000 | 45% | 9 | £210,000 |

North West | £62,000 | 42% | 9 | £215,000 |

Yorkshire and the Humber | £55,000 | 38% | 9 | £205,000 |

Scotland | £37,200 | 24% | 6 | £154,700 |

North East | £35,000 | 26% | 9 | £165,000 |

England and Wales | £72,100 | 38% | 9 | £285,000 |

How long you stay matters

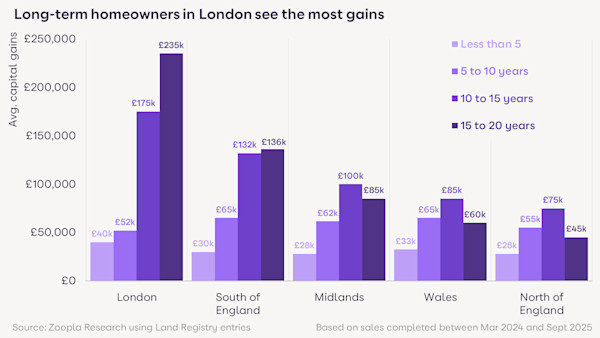

If you think the longer you live in your home, the more profit you’ll make when you sell…well, that’s mostly true. But there’s a twist.

Homeowners who sold after 10-15 years often saw bigger gains than those who stuck it out for 15-20 years. That’s because many long-stayers had the misfortune of owning during the global financial crisis when prices dipped.

In southern England and London, the classic rule applies: the longer you’ve owned, the more you’ve gained.

But in lower-value regions that saw a price boom after Covid, even those who sold after just a few years walked away with solid profits.

How often do people actually move?

Across the UK, the average homeowner stays in their property for 9 years before selling. But in London and the South East, that stretches to 10-11 years. Moving there is pricier (hello, stamp duty) and less affordable, so people stay put longer.

In commuter towns like Dartford, Slough, Watford, Enfield and Romford, the average time before moving is also around 9 years.

In big regional cities like Birmingham, Manchester and Leeds, people also tend to stay put longer than their neighbours.

What does this all mean?

Whether you’re thinking of selling, staying, or daydreaming about what your house could be worth, it’s clear that location and timing play huge roles in the kind of profit you can make.

Some sellers are unlocking enough money to buy a home outright elsewhere, while others are seeing more modest returns. With house price growth now slowing after several years of rapid increases, homeowners who bought more recently may not be looking at gains of £72,000 or more. Still, it’s a useful reminder of how much wealth can build up over time through property ownership.

Whether you’re sitting on a potential six-figure profit or something more modest, your home isn’t just a roof over your head; it’s quietly earning its keep in the background.