Taking your first step on the property ladder in Birmingham? Here at Zoopla, we have data that you might find useful.

It looks at average house prices in the city by postcode and then estimates how much a first-timer would need to earn and have as a deposit to buy there.

We've summarised this data in the map below. It shows what income you would need to buy a two- to three-bedroom property in various postcode areas. In short the greener, the better.

Most affordable areas for first time buyers in Birmingham

(Click on map for larger version)

Quick pointers for first time buyers in Birmingham:

The average first time buyer property (two-to-three bedroom house) in Birmingham costs £179,216, with the average deposit required £26,882. With its regeneration projects, excellent transport links such as the West Midlands Metro, shopping centre and plentiful housing provision, it could represent a great first time buyer option.

Average household income required for first time buyers is £38,097.

Most affordable area of Birmingham is Rough Fields and Priestfield (WV2) with an average house price of £101,617. A deposit of £15,243 and income of £21,594 is required. However, as the post code suggests, it is closer to the city centre of Wolverhampton than Birmingham.

For first time buyer bargains closer to Birmingham city centre itself, Lozells, Newtown and Birchfield (B19) – that is home to track and field's Alexander Stadium – ranks favourably, with the average house price at £111,711.

Solihull and Sutton Coldfield represent the most expensive options for first time buyers. Hockley Heath and Earlswood (B94, Solihull) have an average price of £397,206 and Four Oaks and Little Ashton (B74, Sutton Coldfield) an average of £282,058.

| Postcode | Area | Average house price | Average deposit required | Average household income required |

|---|---|---|---|---|

| WV2 | All Saints, Wolverhampton | £101,617 | £15,243 | £21,594 |

| B19 | Birchfield | £111,711 | £16,757 | £23,738 |

| WS2 | Pleck, Walsall | £113,297 | £16,994 | £24,076 |

| B6 | Aston | £114,364 | £17,155 | £24,302 |

| WV1 | City centre, Wolverhampton | £114,565 | £17,185 | £24,345 |

| DY2 | Town centre, Dudley | £117,328 | £17,599 | £24,932 |

| WV13 | Willenhall | £119,398 | £17,910 | £25,372 |

| WS3 | Bloxwich, Walsall | £119,488 | £17,923 | £25,391 |

| B7 | Nechells | £119,958 | £17,994 | £25,491 |

| B21 | Handsworth | £119,968 | £17,995 | £25,493 |

First time buyer affordability in the West Midlands

In certain areas of the UK, especially London and the South East, it's almost impossible to find postcode areas where average salaries are high enough to get the mortgage you would need to get on the housing ladder.

The good news with Birmingham and the wider West Midlands region is that, in many cases, four times average earnings will be enough for first time buyers to take an initial step on to the property ladder.

Birchfield, close to Birmingham city centre falls into this category, as does B37 that takes in Chelmsley Wood and Marston Green to the east of the city.

If you are looking further afield, north and east of Birmingham provides the most affordable options. First time buyers can find property in Stoke-on-Trent's ST1 postcode area for an average of £85,386, which demands an average first time buyer's household income of £18,145.

Burton-upon-Trent, Tamworth and Nuneaton are all viable alternatives to the east, and Bromsgrove to the south west could also be a more affordable choice within commuting distance of Birmingham.

How have we calculated it?

We've looked at the average price of two-to-three bedroom homes – the most common type of property purchase for first time buyers in Birmingham.

We've then taken the average mortgage advance from mortgage lenders in the region and worked out the average deposit and average salary required for the loan (based on four times' salary).

How can I afford a home as a first time buyer?

Building as big a deposit as possible is the first step. This allows you to borrow a smaller percentage of the value of the property and access cheaper mortgage rates.

Aim for a minimum 10% deposit. It is possible to put down less in some cases, but this means less favourable mortgage rate which results in higher monthly mortgage payments.

If you are struggling to raise a deposit, check out Help to Buy where the Government will lend you up to 20% of the purchase price interest-free for the first five years through an equity loan scheme.

Alternatively you could look at a shared ownership scheme via a local housing association. This allows you to purchase between 25% and 75% of the property and pay an affordable rent on the remainder.

Provided your credit rating is in good order and your monthly outgoings do not limit your ability to repay a mortgage, banks and building societies will lend up to around four times your gross annual salary.

If you are buying as a couple, then combining your incomes will mean you can borrow more. It's important to be realistic with your calculations.

If you stretch yourself too far, you'll have no disposable income left to enjoy yourself and, while your new home might be a delight, it won't be as much fun if you're broke and miserable.

Don’t forget that, when buying a home, there will be other fees for licensed conveyancers and and moving costs. Everything should be explained to you, but check there are also no hidden fees such as annual maintenance costs you weren't expecting.

The good news is that stamp duty land tax is waived for first time buyers on the first £300,000 of the purchase. To see how stamp duty might affect you, check out Zoopla's stamp duty calculator.

It's worth shopping around to find an affordable mortgage rate that is right for you. An independent mortgage adviser should be able to help.

Some work on commission, others will charge a fixed fee for mortgage advice. It's also worthwhile speaking to your bank and checking out comparison sites such as uSwitch.com and Money.co.uk for an instant online look at potential deals.

For more help purchasing your first home, read our first time buyer guides.

First time buyer affordability in the UK

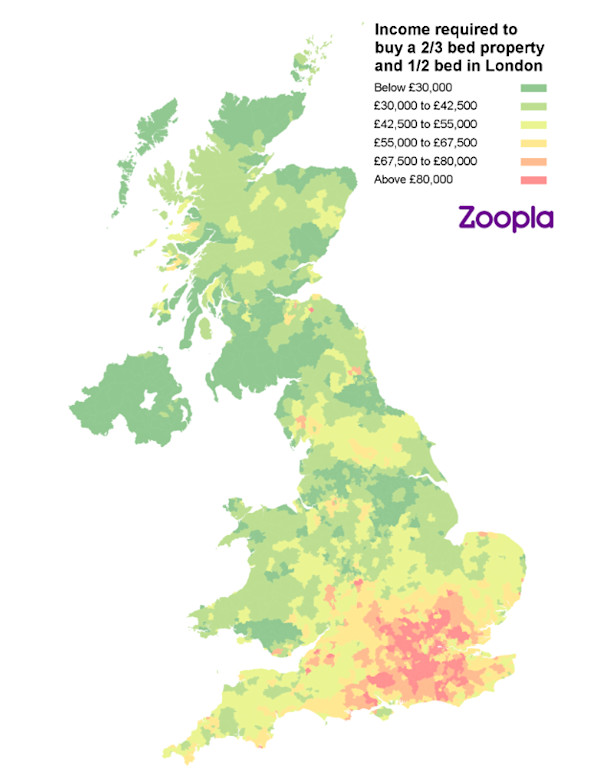

If you're prepared to cast your search further afield still, then our first time buyer affordability map of the UK will help.

There are more affordable alternatives to the West Midlands if you venture either northwards or into Wales beyond Cardiff.

Know your budget in 2 minutes

Discover the maximum mortgage you could get

Establish your monthly repayments

See homes you know you can afford

With no fees and no credit checks on your finances.

But remember that while the UK map might prove a helpful overview, in practice, UK property markets operate on a hyper-local level.

This means that researching cities down to even a street-by-street level will give you the best chance of getting the best value property.

Full methodology: House prices taken from a subset of Zoopla-partner Hometrack's stock valuation database (one-to-two beds for London and two-to-three bedrooms for rest of UK). Median price calculated as of June 2018. Median advance taken by region (c75% for London, c85% outside of London) from UK Finance. Term of Mortgage: 25 years. Interest rate: 2.00%. Loan to income ratio: 4.0. Earnings required for affordability is greater of those required to satisfy loan-to-income threshold or income required to service the mortgage.