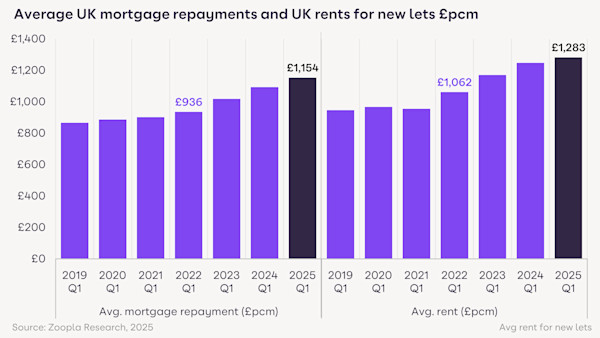

Renters have seen a greater increase in their monthly housing costs than homeowners between 2022 and 2025.

Monthly rents jumped £221 in that time, while the average mortgage repayment rose by £218, according to the Bank of England’s mortgage data.

It brings the new average rent in the UK to £1,283 per month - compared to £1,154 for the average mortgage payment.

It’s a result of ongoing high demand for homes in the private rental sector, while the stock of available rentals has failed to increase due to low levels of new investment by landlords.

Rent vs mortgage: comparing UK housing costs

Some parts of the UK have seen even higher rent increases in the last 3 years, as rental demand has outstripped supply in localised areas.

In places like Oldham, Wigan and Bolton, rents have surged by more than 31%. These previously cheap areas to rent mean there has been more room for rents to rise in relation to affordability.

Rents are highest in London and in some places have risen by £400 since 2022. The capital has seen the biggest increase in pounds and pence, particularly in more affordable parts of outer London, like Ilford.

Where are the biggest rent rises since 2022?

Here are the UK postal areas that have seen the biggest increase in rents over the last 3 years.

Postal area | Average monthly rent: Mar 25 | % change 2022-2025 | £ per month change 2022-25 | Change in annual rental cost 2022-25 |

Oldham - OL | £876 | +35% | +£227 | +£2,724 |

Wigan - WN | £800 | +32% | +£194 | +£2,328 |

Bolton - BL | £884 | +31% | +£211 | +£2,532 |

Falkirk - FK | £881 | +31% | +£207 | +£2,484 |

Walsall -WS | £893 | +30% | +£206 | +£2,472 |

Wolverhampton -WV | £911 | +30% | +£209 | +£2,508 |

Paisley - PA | £763 | +29% | +£170 | +£2,040 |

Tweeddale - TD | £635 | +29% | +£143 | +£1,716 |

Dudley - DY | £878 | +28% | +£190 | +£2,280 |

Ilford - IG | £1,794 | +28% | +£395 | +£4,740 |

Kirkcaldy - KY | £717 | +28% | +£156 | +£1,872 |

Romford - RM | £1,611 | +28% | +£356 | +£4,272 |

Carlisle - CA | £664 | +27% | +£140 | +£1,680 |

Edinburgh - EH | £1,166 | +27% | +£248 | +£2,976 |

Luton - LU | £1,208 | +27% | £258 | £3,096 |

Blackburn - BB | £688 | +26% | +£141 | £1,692 |

Manchester - M | £1,176 | +26% | +£239 | £2,868 |

Medway - ME | £1,239 | +26% | +£254 | £3,048 |

Motherwell - ML | £721 | +26% | +£148 | £1,776 |

Newcastle - NE | £853 | +26% | +£177 | £2,124 |

Slough - SL | £1,599 | +26% | +£326 | £3,912 |

Source: Zoopla Rental Index 2025

What’s causing the ongoing rent rises?

The rise in the cost of renting since 2022 is down to a surge in rental demand in the wake of the pandemic.

A strong labour market and higher levels of migration for work and study boosted demand, and the spike in mortgage rates in 2022-23 made it harder for first-time buyers to get on the ladder.

This meant many first-time buyers have stayed in the rental market for longer, further boosting demand and pushing rents higher.

Robust growth in average earnings over the last three years has supported the faster growth in average rents.

Private renters on lower incomes and those relying on state support have faced an ever greater squeeze on living costs from higher housing costs.

Rental growth has started to slow - now at lowest rate for 4 years

The good news for renters is that the growth in rental rates is now at its lowest rate for 4 years.

Demand has started to weaken due to improvements in the mortgage market for first-time buyers, as well lower levels of migration.

There’s also a ceiling to how much renters can afford to pay for rent - or are willing to. As rents get closer to this level in local areas, the growth rate is slowing.

But we’re not expecting rents to go down any time soon. The tough path to home ownership for first-time buyers means continued demand for rented homes - in a market that’s had no real increase in supply for a decade.

Looking to keep rental costs down? Here’s how we can help

Let's face it, finding an affordable rental right now feels like trying to win the lottery.

But before you give up and move back in with your parents, we've got some genuinely useful tips and tools to help you keep those rental costs down.

Set up instant property alerts

Be the first to pounce on new, well-priced rentals before someone else does. We’ll send you an instant email alert for every property that fits your criteria, as soon as it hits the market.

Sort by ‘most reduced’

Like finding money down the back of the sofa, but for property. This sort order helps you spot rentals that have had their price cut, making them suddenly much more budget-friendly.

More filters than ever before

Our new filters help you find rentals that match your must-haves and your budget, saving you time and heartache.

Balconies, en-suites, home offices, furnishing, student accommodation - you name it, we’ve got a filter for it.

Search by travel time

Because nobody wants a nightmare commute. Find rentals based on how long it takes to get to work (or the pub), helping you discover cheaper areas just a few extra minutes away.

Draw a map

Target the areas where your budget actually stands a chance. Our map search lets you define your exact search area, right down to the street.

Price per month or week

See the true cost of that rental, broken down to fit your budgeting style.

Renting guides

Your secret weapon for savvy renting. Get tips on negotiating, budgeting and finding value in a tricky market.

The expert’s view: “The quickest way to alleviate high rents is to grow rental stock”

“Rental inflation for new lets has slowed to its lowest rate for four years which will be welcome news for Britain’s private renters," says Richard Donnell, Executive Director at Zoopla.

“The quickest way to alleviate high rents is to grow the stock of homes for rent in both the social and private rented sectors. Growing housing supply is a key Government target and it’s vital that the stock of rented homes is expanded across all tenures.

“Renters have faced steep increases in the cost of renting in recent years. Rents have been pushed higher due to high demand and limited supply, hitting lowest-income renters the hardest.”