Half of the UK’s 30 million homes increased in value in 2024.

House prices returned to growth following price falls in 2023, due to weakened buyer demand as a result of higher borrowing costs.

15 million homes increased in value by one per cent or more last year, up 42 per cent from the 10.6 million homes that increased in value over 2023.

The average increase in value for homes posting price gains was £7,600, with 6.9 million homes recording a price increase of £10,000 or more.

While 2024 saw a broad recovery of house prices, a third (9.2 million homes) still recorded a price decline of one per cent or more.

However, this is less than the number of homes that saw a decline in 2023: 12.8 million.

Just under six million homes saw broadly static prices over the year changing by +/- one per cent.

Half of homes in Great Britain increased in value in 2024

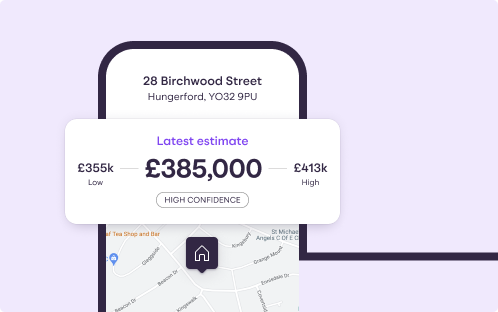

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

Home value gains lower in Southern England

A clear north-south divide remains when it comes to the fortunes of homeowners in 2024, with fewer homes in southern England recording an increase compared to the rest of Britain.

This reflects the underlying affordability of homes: higher mortgage rates affect buying power and house prices more in areas where home values are above average.

Just a third (36 per cent) of homes increased in value by one per cent or more across southern England. And two-fifths (41 per cent) of homes fell in value by an average of £8,700.

This is in sharp contrast to the northern regions of England and Scotland, where 63 per cent of homes registered value gains over 2024.

Coastal towns in Kent and East Sussex were least likely to register price gains in 2024. Many saw less than ten per cent of homes increase in value, while more than three-quarters of homes registered small price falls.

This is due to the fading of the pandemic boom and the subsequent search for additional space as more workers return to the office.

An additional factor is the increase in second homeowners selling in the face of a doubling in council tax from April, which is impacting pricing across many coastal towns.

Average value change by region

Region/ Country | Avg. value change over 2024 | % of homes with value increase of 1% or more | No. of homes with value increase of 1% or more | % of homes with value decrease of 1% or more | No. of homes with value decrease of 1% or more |

North West | £4,400 | 63% | 2,090,000 | 21% | 710,000 |

North East | £4,300 | 68% | 820,000 | 19% | 230,000 |

West Midlands | £3,900 | 59% | 1,480,000 | 22% | 560,000 |

Yorkshire & Humberside | £3,700 | 61% | 1,500,000 | 23% | 570,000 |

Scotland | £3,200 | 61% | 1,580,000 | 24% | 640,000 |

Wales | £2,300 | 52% | 760,000 | 29% | 420,000 |

East Midlands | £1,700 | 48% | 1,010,000 | 31% | 660,000 |

London | £600 | 40% | 1,510,000 | 37% | 1,430,000 |

South West | -£300 | 37% | 970,000 | 40% | 1,040,000 |

South East | -£900 | 35% | 1,390,000 | 41% | 1,620,000 |

East of England | -£1,300 | 33% | 880,000 | 43% | 1,150,000 |

Lower mortgage rates and rising incomes over 2024 have started to repair housing affordability.

More homes in Southern England increase in value over 2024 compared to 2023, from 2.8 million in 2023 to 4.8 million in 2024.

Areas in Wiltshire, Gloucestershire and Oxfordshire saw half of all homes register price gains over 2024. Additionally, Berkhamsted in Hertfordshire saw the largest national average annual price increase at £24,500.

Research sold house prices

Find out what a home last sold for or check house prices in a city, street or postcode.

House value increases most common in Northern England

Housing is more affordable outside of Southern England, where house prices are lower in comparison to incomes.

Lower house prices create more headroom for values to increase, despite higher borrowing costs. And more than three in five homes increased in value over 2024 across Northern England and Scotland

The North East is one of the most affordable regions and, as a result, seven in ten homeowners (820,000) in the region saw the value of their home increase by an average of £4,300.

One in five (270,000) homeowners saw house price growth of £10,000 or more.

Peterlee in County Durham saw the highest proportion of properties registering higher home values, with 83 per cent registering an increase by an average of £6,100.

The North West saw 63 per cent of homes increasing in value by one per cent or more, averaging £4,400, the highest average gain across all regions and countries of Great Britain.

The Cheshire area registered the largest value gains, with six in ten homes in Congleton and Knutsford increasing in value by £10,000 or more.

In Scotland and Yorkshire and the Humber, six in ten homes also gained value in 2024, with average increases of up to £19,300 (Biggar in Scotland), and £15,700 (Ripon in Yorkshire and the Humber).

Towns with the highest percentage of homes increasing in value in 2024

Region/ Country | Town | % homes with value increase of 1%+ | No. of homes going up in value | Avg. value change (£) |

East Midlands | Glossop | 67% | 10,700 | £7,000 |

East of England | Berkhamsted | 53% | 5,900 | £24,500 |

London | Waltham Forest | 64% | 74,800 | £8,700 |

North East | Peterlee | 83% | 14,500 | £6,100 |

North West | Blackburn | 77% | 48,700 | £8,100 |

Scotland | Carluke | 82% | 7,800 | £8,900 |

South East | Thame | 56% | 4,100 | £5,600 |

South West | Portland | 54% | 3,700 | £2,900 |

Wales | Ferndale | 74% | 4,500 | £3,900 |

West Midlands | Wednesbury | 79% | 16,600 | £6,000 |

Yorkshire and Humber | Normanton | 81% | 8,700 | £7,500 |

Towns with the highest percentage of homes decreasing in value in 2024

Region/ Country | Town | % homes with value decrease of 1%+ | No. of homes falling in value | Avg. value change (£) |

East Midlands | Corby | 74% | 24,700 | -£6,000 |

East of England | Bungay | 79% | 4,400 | -£8,400 |

London | Kensington and Chelsea | 72% | 73,200 | -£44,300 |

North East | Houghton Le Spring | 48% | 13,100 | £3,800 |

North West | Cheadle | 54% | 14,100 | -£2,000 |

Scotland | Inverurie | 65% | 11,100 | -£4,200 |

South East | Broadstairs | 89% | 11,800 | -£15,300 |

South West | Ferndown | 83% | 11,500 | -£14,400 |

Wales | Pwllheli | 64% | 6,800 | -£3,650 |

West Midlands | Evesham | 45% | 10,000 | £900 |

Yorkshire and Humber | Beverley | 57% | 12,800 | -£5,100 |

Our Executive Director Richard Donnell says: "The housing market returned to growth in 2024 but the pattern of home value changes across Britain is far from uniform. There is headroom for prices to increase in markets where housing is affordable compared to incomes, which covers many parts of northern England and Scotland.

"In contrast, affordability is more of a constraint on price rises in Southern England where the market continues to adjust to higher borrowing costs. Faster income growth is helping to repair affordability-supporting moving decisions in 2025.

“Every home has its own trajectory for price changes and millions of owners are tracking the value of their home on Zoopla as part of the decision of when to move home. The momentum from 2024 is spilling into 2025 with a seven-year high in the number of homes for sale.

"We expect more people to move home in 2025 than in 2024 despite uncertainty over the economic outlook and broadly static mortgage rates."

Know your budget in 2 minutes

Discover your maximum borrowing power

Establish your monthly repayments

See homes you know you can afford

With no fees and no credit checks on your finances.