Key figures

The average rent for new lets in the UK is £1,320 (or £15,840 a year) as of December 2025 (data to October 2025).

Rents have risen 2.2% in the last year, down from 3.3% a year ago and the slowest rate of growth in 4 years.

This is down to a narrowing demand and supply gap, with demand falling by a fifth in the last year and the supply of available rental homes rising by 15%.

Rental demand at its lowest level in 6 years

Rental demand is down by a fifth compared to last year and at its lowest at this time of year for 6 years. There are two key factors playing into this.

A large decline in net migration is having the most significant impact on rental demand. Many people coming to the UK to work and study look to the rental market for their housing needs.

New ONS estimates show a 78% decline in net migration over two years: from 924,000 people in the year to June 2023 to 204,000 in the year to June 2025. This drop in migration is having a direct impact on the level of rental demand across the country.

A secondary factor in lower rental demand is improved mortgage affordability for first-time buyers. The UK is on track for more than 350,000 people to buy their first home in 2025, and there was a 20% increase in the number of first-time buyer mortgages in the 9 months to September 2025 (UK Finance).

Many first-time buyers were previously renters, so more people getting on the housing ladder means more rental homes are freed up - a key reason behind the 15% rise in rental supply.

While this trend is helping ‘better off’ renters to buy, most households on lower incomes only have private renting as their main housing option.

Affordability boost: Rents rising more slowly than earnings

Rents usually rise in line with earnings over the long run. However, 2022-23 saw a rapid rise in rents which outstripped the growth in average earnings. This stretched rental affordability to its limits.

Rents are now rising more slowly than earnings growth. We expect this trend to run into 2026 and help repair affordability for renters across the UK.

Supply of rental homes up 15% on last year

A shortage of homes for rent has defined the market in recent years. It’s pushed rents higher and stretched affordability across the rental market.

But supply is recovering, with national rental supply 15% higher than a year ago.

Availability is up by more than 20% in the North West, North East, South West and Wales. This reflects the stronger first-timer buyer activity in these regions, freeing up more rentals, alongside homes that fail to sell being placed on the rental market.

Supply is slower in London (6%) and Scotland (9%), which will keep more pressure on rental rates. In London, weak landlord economics - high purchase costs and low rental yields - are prompting continued sales of rental homes. Nearly a third of homes for sale in the capital (31%) are former rentals, which is almost 3 times the average across the rest of the country (12%).

We expect rental affordability across the UK to return to pre-pandemic levels in the coming year. This will improve choice for tenants and help to contain rental inflation at more affordable levels.

Homes are taking longer to rent

The time it takes for a property to rent is a key barometer of rental market health. It shows how supply and demand are shifting in real-time.

The time to rent has increased, with homes staying on the market for 17 days before being rented over the last 3 months.

This is almost 20% slower than a year ago, and 42% slower than the pandemic boom in rental demand.

The time to rent has increased across all regions and countries of the UK as the pressure on the rental market has cooled. The average across regions ranges from 14 days in Scotland to 19 in the West Midlands.

Longer times to let will limit how much rents can increase, supporting lower levels of rental growth in 2026.

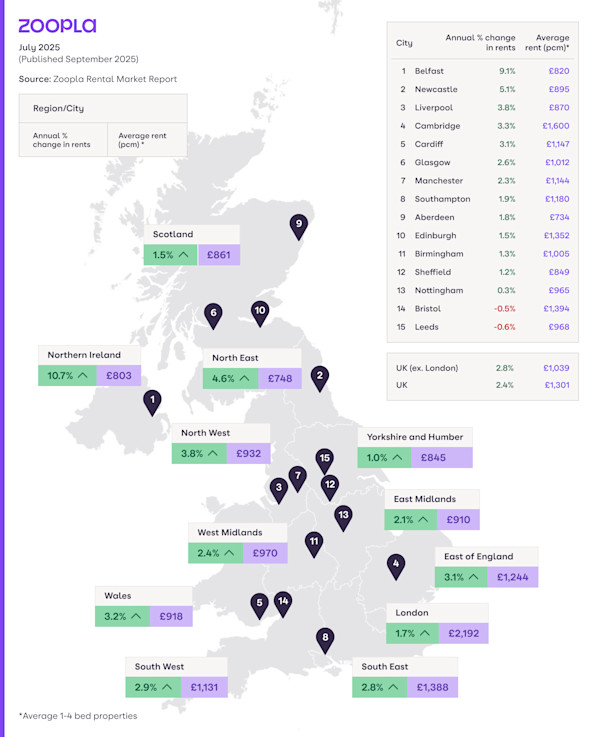

Rents rising faster in more affordable markets

There has been a slowdown in rental inflation across all regions and countries of Great Britain due to the levelling of supply and demand.

At a regional level, rents are rising fastest in the North East (4.5%) and the North West (3.2%). In terms of local markets, the strongest rental growth is in Carlisle (8.1%), Chester (7.4%) and Motherwell (7%). These are lower-value markets where affordability leaves more headroom for rent increases.

At the other end of the spectrum, regional rents are rising most slowly in London (1.6%), the West Midlands (1.7%) and Scotland (1.7%). Some local markets are seeing rents fall, including Birmingham (-1.5%) and Dundee (-1%). Many of these are higher-value areas where stretched affordability is limiting further rises.

These differences reflect local shifts in supply and demand, as well as the affordability of rents relative to local incomes.

What will happen to rents in 2026?

The rental market is shifting back towards more ‘normal’ levels of activity, which supports sustainable levels of rent rises. A modest supply/demand imbalance remains, which will keep rents rising gradually: we expect rents to rise by 2.5% in 2026.

New investment from landlords remains limited and the number of rented homes is broadly unchanged for a decade, with little prospect of near-term growth.

Slower rental inflation is a reflection of both weaker demand and stretched affordability. But many low-to-middle income renters continue to rely on the rental sector with buying a home remaining expensive. This core group will play a key role in determining how much rents can rise in the years ahead.

Rents and rises across the UK

About the Zoopla Rental Market Report

Our Rental Market Index is a repeat transaction index, based on asking rents and adjusted to reflect achieved rents. The index is designed to accurately track the change in rental pricing for UK housing.

Notes on this month's data:

UK rents increased by 2.2% over the last 12 months: in the 4 weeks to 30th November 2025 vs same period in 2024

The migration figures are ONS data for long-term international migration, provisional: year ending June 2025.

First-time buyer numbers are UK Finance data: YoY change in FTB loans, Jan to Sept 205 vs same period in 2024.

Rental supply is Zoopla research analysis of homes for sale and previous rented, covering sales listings in Q3 2025.

Time to rent is a Zoopla analysis of time to rent for rental listings, 3-months average to Nov 2025.

Previous Rental Market Reports

See more news from our Rental Market Report